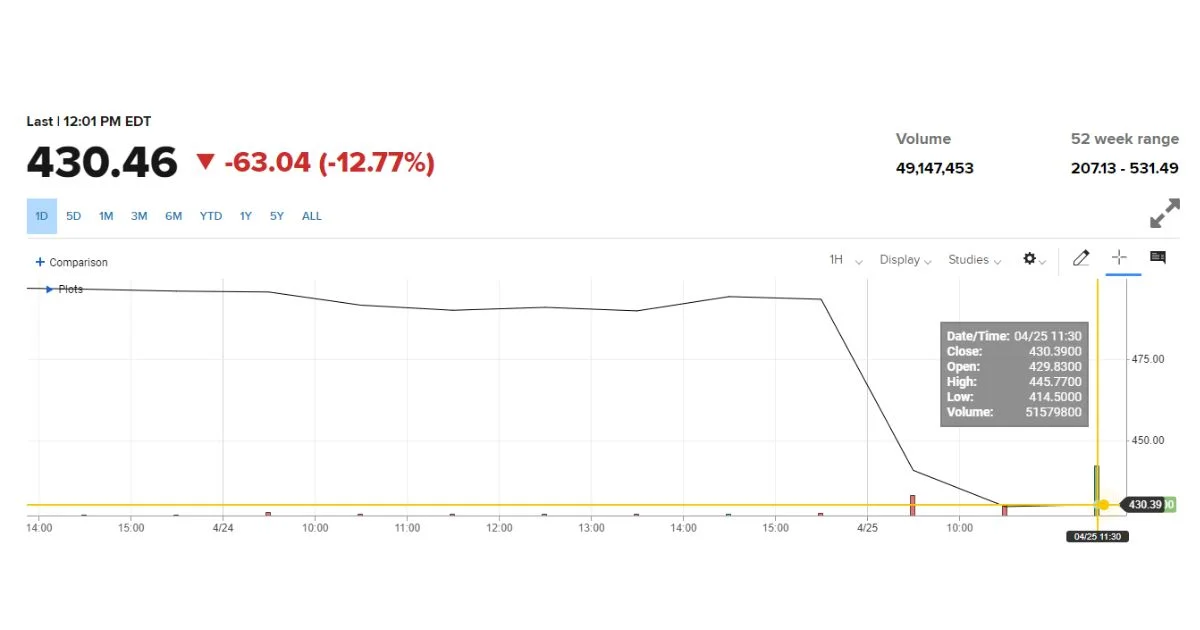

In the world of finance, one company’s stock can be like a rollercoaster ride, and Meta, formerly known as Facebook, is no exception. On Wednesday, April 24, 2024, Meta’s stock took a plunge, falling by over 15% in extended trading. What caused this sudden drop? Let’s dive into the details.

Meta Stock Dips After Mixed Earnings Report

Despite posting better-than-expected first-quarter results, Meta stock faced a rough patch as investors reacted to a moderate forecast for the future. The company reported a whopping 27% increase in revenue compared to the same quarter in 2022, marking its fastest quarterly expansion since 2021. Net income also more than doubled, reaching $12.37 billion.

So, why the gloomy outlook? Well, during the earnings call, CEO Mark Zuckerberg discussed investments in areas like glasses and mixed reality, which aren’t currently profitable for Meta. This sparked concerns among investors, leading to a flurry of sell-offs and the subsequent drop in stock value.

One key factor contributing to the increased net income was a significant decrease in sales and marketing costs. Meta also announced its expectations for sales in the second quarter, falling slightly below analysts’ estimates.

But it’s not all doom and gloom for Meta. Despite the recent setback, the company has been on an upward trajectory, with its stock rising approximately 40% this year alone. In fact, 2023 was dubbed the “year of efficiency,” with Zuckerberg pledging to streamline operations and focus on creating a stronger organization.

However, challenges remain, particularly in Meta’s Reality Labs unit, which continues to report significant losses. Despite efforts to rebuild its ad business and invest in AI, concerns linger about potential decreased spending from China-based advertisers.

So, what’s next for Meta? Well, only time will tell. As the company navigates through these challenges, investors will be eagerly awaiting updates on its progress and future outlook.

In the volatile world of stocks, ups and downs are inevitable. And while Meta may have hit a bump in the road, its journey is far from over. As always, investors should approach with caution and keep a close eye on developments as they unfold.

Hope our blog on Meta Stock Fall was helpful to you and exciting to read !!

Please feel free to leave a comment below if you have any questions or thoughts.